The total adhesives & sealants market is expected to reach 70 billion by the end of 2023 growing at a CAGR of 5.5% from 2018-2023. The major factors contributing towards the growth are use of adhesives & sealants in various applications, continuous R&D to develop new products, and increasing automotive production are some of the factors driving the adhesives & sealants market.

Asia-Pacific region has been dominating the adhesives & sealants market in 2018 and is expected to continue to account for the major market through 2023, followed by Europe and North America. China will continue to capture the largest share in the next five years mainly due to high demand of adhesives & sealants from construction, healthcare, automotive, and consumer products.

The various applications of adhesives are paper, board & related products transportation, footwear, consumer, building and construction, woodworking and others. The various applications of sealants covered in this market are construction, transportation, consumers, assembly, and others

Companies are adopting various strategies by creating competitive advantage by capturing new technologies, and leverage more and more customized products to cater various industry segments. For instance, in 2017, Ashland has developed two innovative pressure sensitive adhesives for various demanding application such as foil tape and medical applications.

Some of the major companies in the North America market are 3M, Ashland Chemical, BASF, Bemis (MACtac), Bostik, Chemence, Craig Adhesives and Coatings, Dow Automotive, Dow Corning, Franklin International, H.B. Fuller, Henkel Corporation and others. We have covered 40+ players from North American region. Similarly, various players from each region have studied individually. We have profiled around 300+ players in adhesives & sealants market globally.

Report Highlights

1. We have analysed 50 countries for each type of adhesives & sealant

2. Each type of adhesive and sealant is further analysed by chemistry and industry

3. Detailed analysis of country wise growth drivers such as end use industry growth, macroeconomic and demographic indicators

4. More than 300+ producers of adhesive and sealants have been profiled in this report. Approximately 240 belong to China; capacity data for most of the players have been verified.

Market share analysis across North America, Europe, APAC & Rest of the World

Report Scope

The research of adhesives and sealants market mainly focuses the 50 countries across North America, South America, Europe, Asia pacific and Rest of the World covering:

Adhesives & sealants market (2016, 2017 to 2022) by technology, chemistry and end use industry (country level analysis will be done for more than 50 countries across NA, WE, CEE, LatAm, APAC & MEA)

Samples (Please note the samples are not exhaustive in nature)

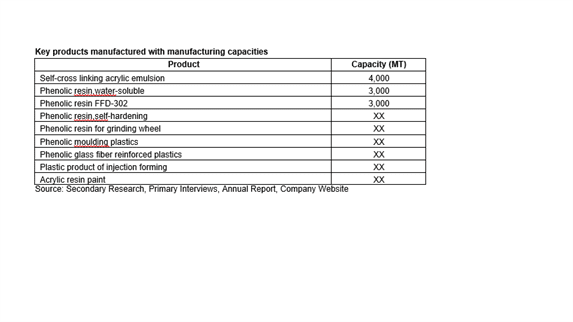

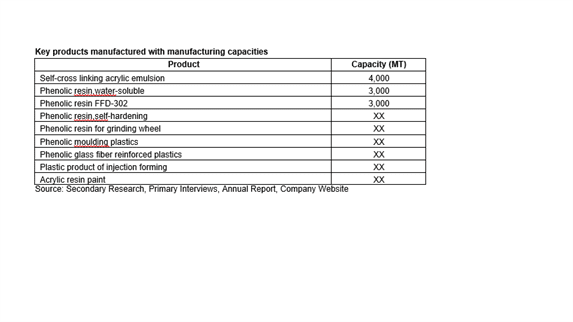

Brief Company Profile – Shandong Beifang Xiandai Chemical Industry Co. Ltd.

Company Name: Shandong Beifang Xiandai Chemical Industry Company Limited

Address: Xinchengzhuang, Tianqiao District, Jinan City Shangdong (250033)

Director: Kong Lingsheng

1. Introduction

1.1. Goal & Objective

1.2. Report Coverage

1.3. Supply Side Data Modelling & Methodology

1.4. Demand Side Data Modelling & Methodology

2. Executive Summary

3. Market Outlook

3.1. Introduction

3.2. Current & Future Outlook

3.3. DROC

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.3.4. Challenges

3.4. Market Entry Matrix

3.5. Market Opportunity Analysis

3.6. Market Regulations

3.7. Pricing Mix

3.8. Key Customers

3.9. Value Chain & Ecosystem

3.10. Macroeconomic Indicators

3.10.1. GDP for Major Countries

3.10.2. Construction Industry Analysis

3.10.3. Oil & Gas Industry Analysis

3.10.4. Automotive Industry Analysis

3.10.5. Healthcare Industry Analysis

4. Demand Market Analysis

4.1. Adhesives Market, By Type

4.1.1. Natural Polymers Adhesive

4.1.1.1. By chemistry

4.1.1.1.1. Protein

4.1.1.1.2. Animal Glues

4.1.1.1.3. Vegetable

4.1.1.2. By industry

4.1.1.2.1. Paper, board & related products

4.1.1.2.2. Transportation

4.1.1.2.3. Footwear

4.1.1.2.4. Consumer

4.1.1.2.5. Building and construction

4.1.1.2.6. Woodworking

4.1.1.2.7. Assembly

4.1.1.2.8. Others

4.1.2. Hotmelt adhesives

4.1.2.1. By Chemistry

4.1.2.1.1. Polyolefin

4.1.2.1.2. EVA

4.1.2.1.3. Polyamide

4.1.2.1.4. Saturated Polyester Resin

4.1.2.1.5. Styrene Block Copolymers

4.1.2.1.6. Polyurethane

4.1.2.1.7. Others

4.1.2.2. By industry

4.1.2.2.1. Paper, board & related products

4.1.2.2.2. Transportation

4.1.2.2.3. Footwear

4.1.2.2.4. Consumer

4.1.2.2.5. Building and construction

4.1.2.2.6. Woodworking

4.1.2.2.7. Assembly

4.1.2.2.8. Others

4.1.3. Polymer dispersion and emulsion

4.1.3.1. By Chemistry

4.1.3.1.1. EVA based

4.1.3.1.2. Vinyl Acetate Based

4.1.3.1.3. Natural rubber

4.1.3.1.4. SBR

4.1.3.1.5. Acrylic

4.1.3.1.6. PU

4.1.3.1.7. Others

4.1.3.2. By industry

4.1.3.2.1. Paper, board & related products

4.1.3.2.2. Transportation

4.1.3.2.3. Footwear

4.1.3.2.4. Consumer

4.1.3.2.5. Building and construction

4.1.3.2.6. Woodworking

4.1.3.2.7. Assembly

4.1.3.2.8. Others

4.1.4. Solvent Based Adhesive Analysis

4.1.4.1. By chemistry

4.1.4.1.1. Polychloroprene

4.1.4.1.2. Polyurethane

4.1.4.1.3. Block copolymers

4.1.4.1.4. Natural & Synthetic Rubbers

4.1.4.1.5. Others

4.1.4.2. By industry

4.1.4.2.1. Paper, board & related products

4.1.4.2.2. Transportation

4.1.4.2.3. Footwear

4.1.4.2.4. Consumer

4.1.4.2.5. Building and construction

4.1.4.2.6. Woodworking

4.1.4.2.7. Assembly

4.1.4.2.8. Others

4.1.5. Reactive Analysis

4.1.5.1. By chemistry

4.1.5.1.1. Epoxy

4.1.5.1.2. PU

4.1.5.1.3. Saturated Polyester

4.1.5.1.4. Radiation Cure

4.1.5.1.5. Acrylics

4.1.5.1.6. Formaldehyde

4.1.5.1.7. Others

4.1.5.2. By industry

4.1.5.2.1. Paper, board & related products

4.1.5.2.2. Transportation

4.1.5.2.3. Footwear

4.1.5.2.4. Consumer

4.1.5.2.5. Building and construction

4.1.5.2.6. Woodworking

4.1.5.2.7. Assembly

4.1.5.2.8. Others

4.1.6. Water soluble polymers based adhesives

4.1.6.1. By chemistry

4.1.6.1.1. Polyvinyl Alcohol

4.1.6.1.2. Cellulosics

4.1.6.1.3. Others

4.1.6.2. By industry

4.1.6.2.1. Paper, board & related products

4.1.6.2.2. Transportation

4.1.6.2.3. Footwear

4.1.6.2.4. Consumer

4.1.6.2.5. Building and construction

4.1.6.2.6. Woodworking

4.1.6.2.7. Assembly

4.1.6.2.8. Others

5. Sealants Market, by Type

5.1. Oil-base caulks by market segments

5.1.1. Construction

5.1.2. Transportation

5.1.3. Consumer

5.1.4. Assembly

5.1.5. Others

5.2. Latex acrylic sealants by market segments

5.2.1. Construction

5.2.2. Transportation

5.2.3. Consumer

5.2.4. Assembly

5.2.5. Others

5.3. Polyvinyl acetate caulks by market segments

5.3.1. Construction

5.3.2. Transportation

5.3.3. Consumer

5.3.4. Assembly

5.3.5. Others

5.4. Butyl sealants by market segments

5.4.1. Construction

5.4.2. Transportation

5.4.3. Consumer

5.4.4. Assembly

5.4.5. Others

5.5. Polysulfides by market segments

5.5.1. Construction

5.5.2. Transportation

5.5.3. Consumer

5.5.4. Assembly

5.5.5. Others

5.6. Urethanes by market segments

5.6.1. Construction

5.6.2. Transportation

5.6.3. Consumer

5.6.4. Assembly

5.6.5. Others

5.7. Silane Modified Polymers by market segments

5.7.1. Construction

5.7.2. Transportation

5.7.3. Consumer

5.7.4. Assembly

5.7.5. Others

5.8. Silicones by market segments

5.8.1. Construction

5.8.2. Transportation

5.8.3. Consumer

5.8.4. Assembly

5.8.5. Others

6. Adhesives & Sealants Market, By Region

6.1. North America

6.1.1. U.S.

6.1.2. Canada

6.1.3. Mexico

6.2. Western Europe

6.2.1. Austria

6.2.2. Belgium

6.2.3. Netherlands

6.2.4. France

6.2.5. Germany

6.2.6. Britain

6.2.7. Italy

6.2.8. Denmark

6.2.9. Finland

6.2.10. Norway

6.2.11. Sweden

6.2.12. Spain

6.2.13. Portugal

6.2.14. Switzerland

6.2.15. Greece

6.2.16. Ireland

6.3. Western Europe

6.3.1. Hungary

6.3.2. Czech Republic

6.3.3. Slovakia

6.3.4. Turkey

6.3.5. Belarus

6.3.6. Ukraine

6.3.7. Bulgaria

6.3.8. Croatia

6.3.9. Romania

6.4. Asia-Pacific

6.4.1. China

6.4.2. Japan

6.4.3. India

6.4.4. South Korea

6.4.5. Taiwan

6.4.6. Vietnam

6.4.7. Indonesia

6.4.8. Malaysia

6.4.9. Thailand

6.4.10. Philippines

6.4.11. Singapore

6.4.12. Rest of the world

6.5. Middle East & Africa

6.5.1. Saudi Arabia

6.5.2. UAE

6.5.3. Others

6.6. Africa

6.6.1. South Africa

6.6.2. Uganda

6.6.3. Botswana

6.6.4. Others

7. Supply Market Analysis

7.1. Strategic Benchmarking

7.2. Market Share Analysis

7.3. Key Players

7.3.1. Company introduction

7.3.1.1. SWOT analysis

7.3.1.2. Financials

7.3.1.3. Revenue from Adhesive & Sealants

7.3.1.4. Employee

7.3.1.5. R&D details

7.3.1.6. Products offerings

7.3.1.6.1. Adhesives & sealants

7.3.1.6.2. Other products

7.3.1.7. Plant locations

7.3.2. Details of adhesives & sealants plant

7.3.2.1. Installed capacity of adhesives & sealants

7.3.2.2. Capacity expansion plans

7.3.2.3. Capacity shares

7.4. Strategic imperatives

7.5. Key Players (Company Snapshot, Product Portfolio, Financials, and Strategic Analysis)

7.5.1. North America (35+ companies covered in the report from North American region)

7.5.1.1. 3M

7.5.1.2. ADCO Global

7.5.1.3. Ashland Chemical

7.5.1.4. Avery Dennison

7.5.1.5. Chemence

7.5.1.6. Craig Adhesives and Coatings and Others

7.5.2. Europe (30+ companies covered in the report from North American region)

7.5.2.1. Dow Automotive Systems (30+ companies covered in the report from Europe)

7.5.2.2. Dymax

7.5.2.3. Ems-EFTEC

7.5.2.4. Evonik

7.5.2.5. Forbo

7.5.2.6. H.B. Fuller

7.5.2.7. Henkel Technologies

7.5.2.8. Huntsman Advanced Materials

7.5.3. South America (25+ companies covered from South America)

7.5.3.1. 3M do Brasil

7.5.3.2. Amazonas Quimicam Ltda.

7.5.3.3. Amino

7.5.3.4. Artecola

7.5.3.5. Bertoncini Indústrias Químicas Ltda.

7.5.4. Asia-Pacific (40+ players have been profiled)

7.5.4.1. AICA Kogyo Co., Ltd.

7.5.4.2. Alteco Co., Ltd.

7.5.4.3. Auto Chemical Industry Co., Ltd.

7.5.4.4. Axia Korea (Alteco Korea)

7.5.4.5. Cemedine Co., Ltd.

7.5.4.6. Chemitec Co., Ltd.

7.5.4.7. Dainichiseika & Color Co., Ltd.

7.5.4.8. Denki Kagaku Kogyo K.K.

7.5.4.9. DIC Corporation

7.5.4.10. Dongbu Fine Chemicals Co., Ltd.

7.5.4.11. Eternal Chemical Co., Ltd.

7.5.4.12. Great Eastern Resins Industrial Co., Ltd

7.5.5. China Players (More than 100 China players have been profiled)

7.5.5.1. Anhui Wuhu Xingguang Synthetic Material Co.Ltd

7.5.5.2. Anqiu City Lu 'an Pharmaceutical Co. ,Ltd.

7.5.5.3. Beijing Beihua Fine Chemicals

7.5.5.4. Beijing City Dajjaoting Adhesive Factory

7.5.5.5. Beijing City Juhuan Chemical Co. Ltd.

7.5.5.6. Beijing City Miyun County Feng-feng Cement Material Factory

7.5.5.7. Beijing City Tianshan New Material Technology Co. Ltd. & Others

SDMR employs a three way data triangulation approach to arrive at market estimates. We use primary research, secondary research and data triangulation by top down and bottom up approach

Secondary Research:

Our research methodology involves in-depth desk research using various secondary sources. Data is gathered from association/government publications/databases, company websites, press releases, annual reports/presentations/sec filings, technical papers, journals, research papers, magazines, conferences, tradeshows, and blogs.

Key Data Points through secondary research-

Macro-economic data points

Import Export data

Identification of major market trends across various applications

Primary understanding of the industry for both the regions

Competitors analysis for the production capacities, key production sites, competitive landscape

Key customers

Production Capacity

Pricing Scenario

Cost Margin Analysis

Key Data Points through primary research-

Major factors driving the market and its end application markets

Comparative analysis and customer analysis

Regional presence

Collaborations or tie-ups

Annual Production, and sales

Profit Margins

Average Selling Price

Data Triangulation:

Data triangulation is done using top down and bottom approaches. However, to develop accurate market sizing estimations, both the methodologies are used to accurately arrive at the market size. Insert Image